For decades, the source of money in the UK’s property market has remained unclear. The red-brick mansions and shiny office buildings here stand like monuments to impunity. This impunity refers to the fact that properties built over the years with illicit money and those involved in it have not been held accountable. However, with anti-corruption agencies from Bangladesh to Malaysia launching investigations and prosecutions, the UK now faces new challenges. It is being forced to reckon with how it became a haven for kleptocrats and money launderers.

On Monday, the South China Morning Post published a report on the construction of property in the UK with laundered money. It revealed how London has become a safe haven for corrupt money from Southeast Asia and surrounding regions, which came to light following a new investigation in Malaysia.

Malaysia has begun investigating the source of London-based properties owned by former Prime Minister Mahathir Mohamad. Although Mahathir claims these are not illicit assets, in June the British authorities froze nearly $180 million worth of properties belonging to the late tycoon and close associate of Mahathir, Daim Zainuddin, at the request of Malaysia’s Anti-Corruption Commission (MACC). Among the seized assets are two commercial buildings in the London City area, as well as luxury houses and apartments in Marylebone and Bayswater.

Money laundering through UK real estate from Malaysia is not new. Experts say illicit money is often mixed with legitimate assets. It is transferred in ways that conceal the source, using shell companies and offshore structures.

In 2020, U.S. authorities stated that around $340 million worth of properties in the UK were purchased with embezzled money from Malaysia’s 1MDB state investment fund. This money entered the UK through the British Virgin Islands, a territory under the UK known globally as a tax haven, where tax rates are almost zero and financial secrecy is strictly maintained.

Political analyst Azmi Hassan says London is a popular destination for Malaysia’s elites to hold or buy assets. Due to close ties between the two countries, the elites feel comfortable owning property in the UK.

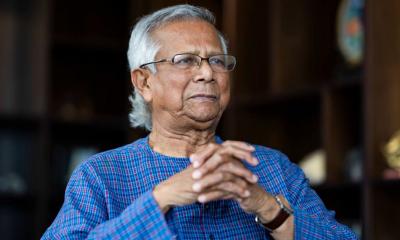

Malaysia is not the only country involved in money laundering through UK real estate. Bangladesh is also on the list. In May, the UK’s National Crime Agency (NCA) seized luxury properties worth nearly £90 million, suspected to be linked to close associates of Bangladesh’s deposed leader Sheikh Hasina. Later, Transparency International UK investigated and found about £400 million worth of assets tied to Sheikh Hasina’s associates, including Mayfair mansions, estates in Surrey, and flats in Merseyside.

These incidents have also affected UK politics. After allegations of involvement with these properties, Sheikh Hasina’s niece, Tulip Siddiq, lost her ministerial position in the UK Treasury. In a statement, Transparency International said that for years they have rolled out the red carpet for oligarchs and autocrats to bring their wealth into the UK.

Similar cases have emerged across Asia. In Singapore, a Chinese citizen was jailed last year in a $2.2 billion money laundering case. Among the accused were two individuals who used offshore companies to buy £56 million worth of property on Oxford Street in London.

Despite regular allegations of illicit property ownership, the UK has taken legal action at a slow pace. Transparency International says that five territories in the Caribbean Sea, such as the Cayman Islands and British Virgin Islands, remain key parts of the global money laundering cycle. Over the past 30 years, nearly £250 billion of illicit money from 79 countries has been laundered through these regions.

Comment :